Revenue vs. Profit: Which Is a More Important Metric?

In the world of business, it’s crucial to understand the distinction between revenue vs profit.

It’s essential to evaluate the health of a business and company, whether it’s the concept of revenue or profit; both contribute significantly to the financial status of the company.

Although the concepts of revenue and profit are related to each other, they represent two very different backgrounds in the evaluation of an entity.

Revenue vs profit: The introduction

Revenue is the total money earned from sales or services before taking out any costs. Profit, also known as net profit or the bottom line, is what’s left after subtracting all the expenses from the revenue.

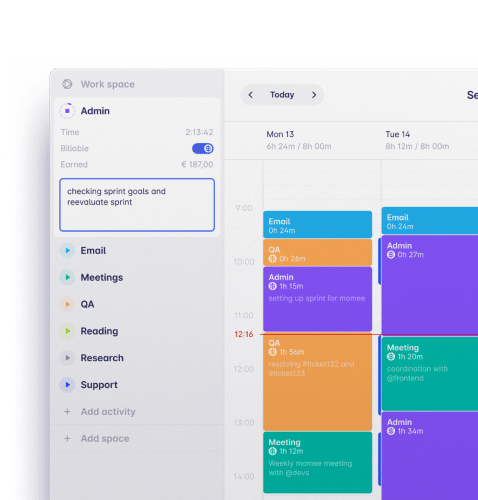

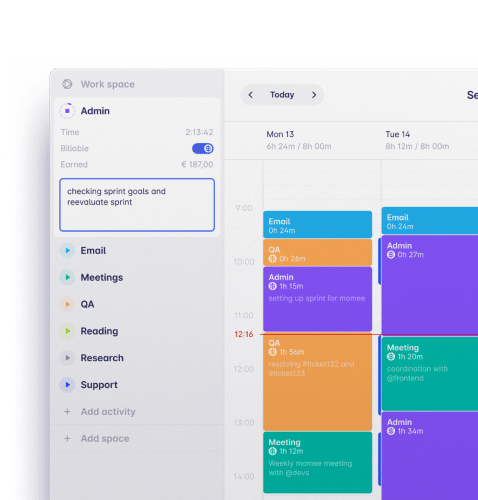

Start tracking your time to increase billable hours and revenue

Track every billable minute to maximize the profitability of your services

While revenue is based on the total amount collected from a project, profit is the difference between the revenue and total expenses. However, these are both significant indicators for stakeholders to oversee in order to understand the company’s efficiency. And that is how you can make an informed and faster decision.

This introduction establishes a frame of reference for the theme that’s about to be explored – revenue vs. profit.

You’ll briefly discover the definition of both concepts, their differences, and which is more important for the evaluation and health of a company.

What is revenue?

Revenue is the total amount of money you might receive from the products or services you sell. It might be the project that you deliver or the consultant services you offer.

This income is generated from the sale of products and/or services, before contemplating expenses or costs.

This indicator allows the company to evaluate its value in proceeding with the delivery of services and/or products.

What is profit?

Profit is the actual gain that you generate from any given project, after the deduction of expenses, costs, and taxes.

In a nutshell, this is a critical mark to define the company’s performance and financial stability.

Read also: How to increase business profitability

Revenue vs. profit: what are the differences?

As mentioned in the introduction, revenue, and profit are both extremely important for the company’s financial structure and analysis. However, they represent very different concepts even though they are correlated. Scroll down to discover the main differences between revenue and profit:

Representation

- Revenue represents the amount made from selling a product and service before deductions.

- Profit happens when you calculate the revenue after all of the deductions of expenses, taxes, and costs.

Formula

- Revenue is calculated when you gather all of the income generated, whether from sales of products or services you’ve provided.

- Profit leans on the subtraction of the expenses, costs, and taxes to the revenue itself.

Position on reports

- Revenue is established on the top, which means the total income generated by the company.

- Profit appears at the bottom of the report because it’s calculated only after all the declared deductions along the report.

Meaning

- Revenue illustrates the company’s ability to generate income from the services and/or products they’re selling, the company’s performance, and its sales volume.

- Profit is the indicator that provides the status of the company’s financial success and actual gain.

Financial health

- The revenue of a company represents the amount of income generated

- The profit actually translates into financial health itself. That happens because the revenue never includes deducting costs and expenses, which the profit looks out for.

The Best Ways to Increase Revenue and Set up Your Business for Success

In this article, we’ve collected the best ways to increase revenue!

Which is a more significant metric: revenue or profit?

Profit is the most important number, and we’re going to explain to you why.

It’s easy to fall into the trap of thinking that your company is safe and growing just by the ability to bring income. But the truth is, it doesn’t matter how much money you can gather from the sale of a service/product because you will only know the actual amount of money you made after the reductions.

Track your time to boost the ROI of your tasks

Track every billable minute to maximize the profitability of your services

Elements such as taxes, expenses, and specific and general costs take a big slice of the profit that you might make.

With that logic in mind, it’s important that you take a closer look when dealing with evaluating a company’s health.

As it was stated before, both indicators are very important to understand their progress, but they are very different from each other.

It’s necessary to keep a perfect balance between those particular concepts since there’s not one without the other, but at the same time, revenue is not all the profit.

The best way to keep up with your business and the financial notions attached to it, it’s best to understand what involves each one, to make business-savvy decisions.

However, since revenue stands out the performance and profit the actual financial gain, it’s obvious that profit holds the more important number.

Profitability is crucial for the continuing competitive aspect and financial growth of every company.

It’s the profit that will be able to endure any business hardship, with the goal of maintaining it as sustainable and secure as possible. Nonetheless, it’s important to generate revenue to increase the amount of income, along with a subsequent larger profit.

The bottom line is that the power of revenue and profit may alternate in different industries and business models available. Some could pay more attention to revenue in order to establish a substantial customer acquisition.

FAQ

Can profit be higher than revenue?

No. Revenue is positioned at the pinnacle of a company’s income statement, signifying its top line. Conversely, profit is commonly known as the bottom line. The reason profit is lower than revenue lies in the deduction of expenses and liabilities.

How much of the revenue is profit?

The portion of revenue that transforms into profit depends on the verification of multiple elements. Industry norms, efficiency, costs, expenses, and the very own nature of the business impact greatly the evaluation of profit.

How to increase revenue?

It’s important to establish a good strategy for customer acquisition and retention, as well as pricing optimization and the evolution of your products and/or services. Invest in marketing actions and expand your target to other markets. Keep reading our article to know the best ways to increase business revenue.

Conclusion

Essentially, what you can take from this article is that both revenue and profit stand as two exceptionally different indicators that help to offer insights into the health of a company.

You are able to see that revenue demonstrates the total income, which analyzes the company’s performance, while profit gives you the margin of success after all of the deductions.

When the profit is positive, that will translate into efficiency, effective cost management, and stability for the company itself.

While the two indicators are essential for a proper evaluation, profit is the one that the stakeholders will pay more attention to.

Ultimately, the balance between the revenue and the profit margin will increase the company’s growth.

You might be interested: