The Best Client Billing Software for 2024

Billing clients can be time-consuming if it is not done efficiently. Generating invoices, sending them out, and tracking down unpaid payments can consume significant time.

Besides that, the process can be costly without you even realizing it. Fortunately, new ways of processing invoices and charging customers are available to meet various needs.

As businesses seek innovative ways to manage finances, exploring the best client billing software options can pave the way for smoother operations and improved client relationships.

But before jumping into the software reviews, we want to share an excellent tip on building your invoices more quickly so that you’ll save a great amount of time.

Your billing process looks cumbersome? Speed it up with Timeular!

Track your billable time accuratrly with the most effortless and intuitive time tracking solution.

How to speed up the billing process

If you want to speed up your client billing process, you have to track accurately your billable time.

Time tracking means keeping track of the hours you work on different tasks. This helps you make invoices faster when you charge by the hour. Here’s how time tracking benefits the billing process:

- Transparency – When you share your timesheets with clients, you build trust and confidence

- Accuracy – By tracking your time, you’ll capture every billable task without guesstimating

- Productivity – When you track time, you easily spot the most time-consuming activities and can take action upon it.

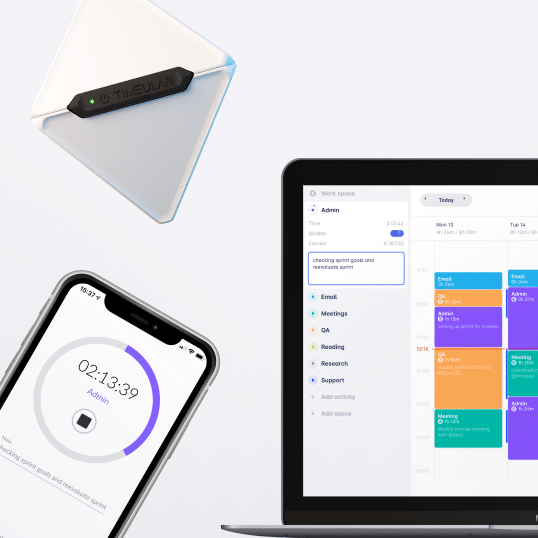

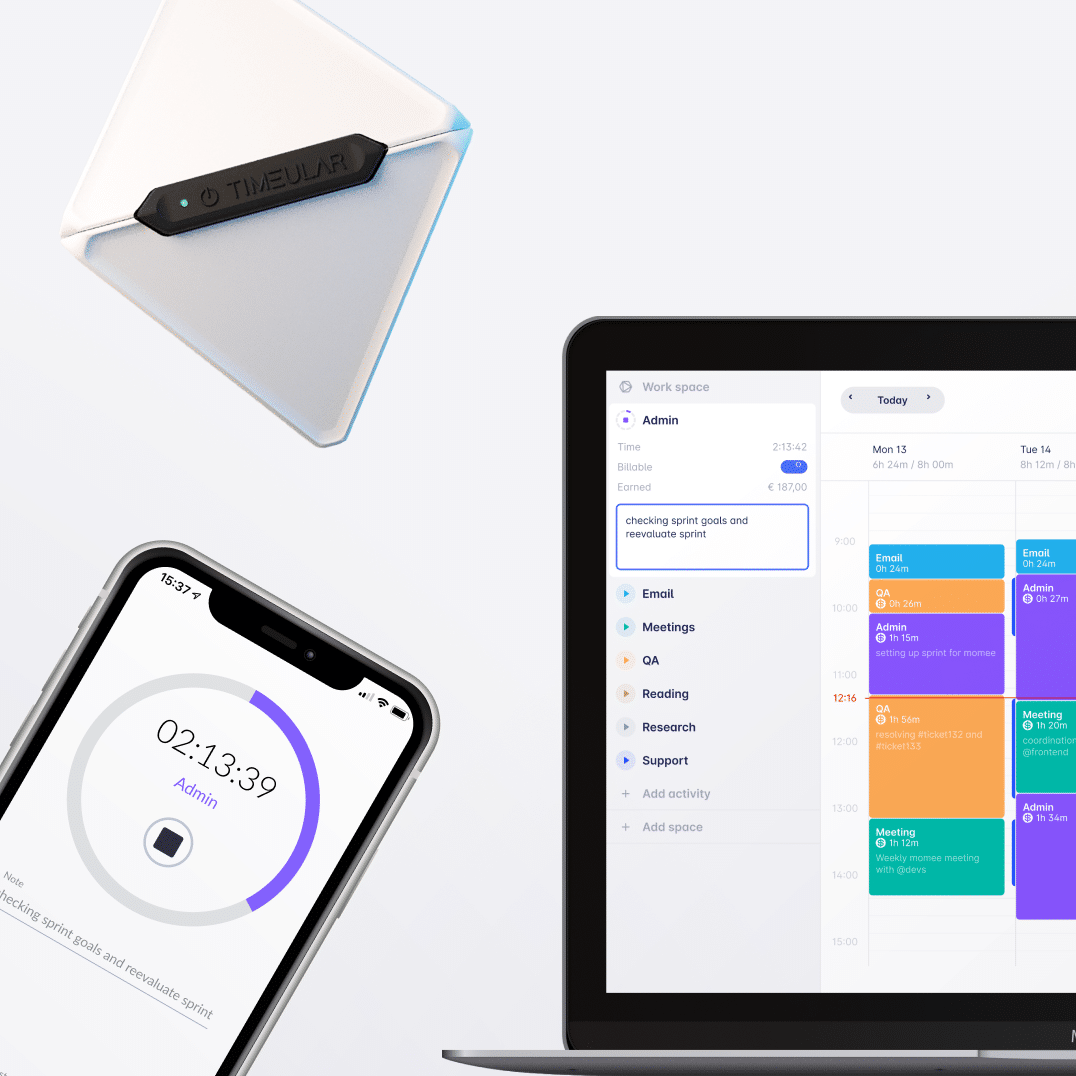

The best tool to track your billable time is Timeular

Timeular is the most effortless and easy-to-use time tracking tool and is among the best billable time trackers. It works perfectly with the most popular client billing software because of its seamless integration capabilities.

Timeular’s main features for billing purposes:

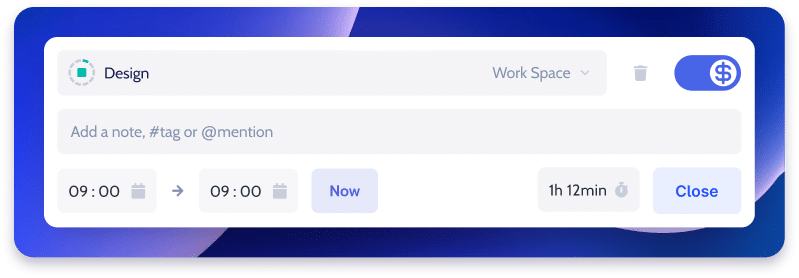

Accurate tracking of billable hours

With Timeular, you can classify each activity as billable or non-billable and assign your billing rates accordingly.

Detailed reporting

The app provides accurate and automated reports that allow clients to have a detailed vision of the work. You can filter the data in multiple ways, round them, and then export them in CSV, XLSX, and PDF.

Automatically fill in your time sheets based on app usage, visited websites, and scheduled calendar events. Say goodbye to guesswork and enjoy accurate time reports with 100% secured privacy.

How an IT consultancy became 20% more profitable by using Timeular

The Tracker is an 8-sided die that connects to the app via Bluetooth. When you flip the Tracker, the app will immediately start tracking time. The Tracker helps to build your time tracking habit and will speed up your invoicing process.

Timeular Tracker works offline and can track up to 1000 activities with just 8 sides. Simply leave one or more sides of your Tracker empty. Every empty side will act like a joker side. It will open Quicktrack and let you choose what you want to track.

Integrate your calendar events into your Timesheets

With one click, you can add your calendar events to your Timeular timesheet. It is especially useful with client meetings and external commitments.

Track paid leave, sick leave, and all other leave types

Add your time off and any type of leave in Timeular to readjust your working week length. The time off will be added to the timesheet. This will help you to be more transparent about your weekly work time with clients. Moreover, the payroll tracker allows you to track work hours for full- and part-time workers, including over- and minus-hours.

Learn more about leave tracking in Timeular.

The exact timing in addition with the rounding feature saves so much time when preparing the invoices for your clients – I can no longer imagine a professional life without Timeular!

Thomas L., Legal Services

Maximize your billable time. Stop guesstimating.

Track your billable time with the most effortless and intutive time tracking solution. If you start tracking today, you get a full month of free Timeular subscription.

The most popular client billing software

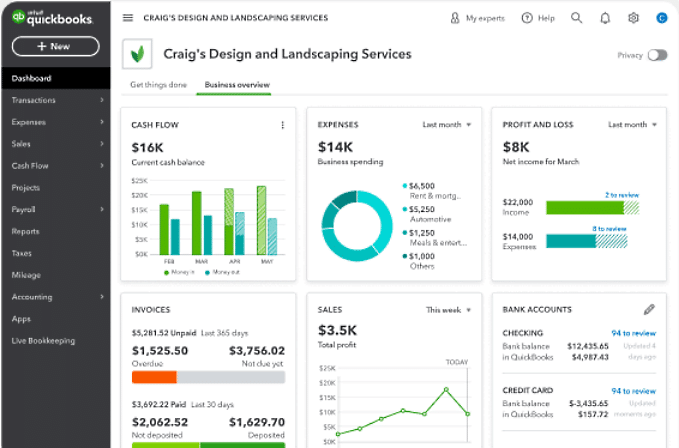

1. QuickBooks

QuickBooks is a very popular and widely used accounting and client billing software for businesses of all sizes.

With QuickBooks, you can create and customize invoices, track expenses, and manage your bills.

It automates many accounting and financial management aspects, making it more accessible for businesses to keep accurate and updated records.

QuickBooks features include:

- Invoice: Create professional invoices, customize templates, automatically add billable hours to them, and track payment status.

- Expense Tracking: Easily record and categorize business expenses for accurate financial reporting. It also allows you to track expenses throughout the year so that you can manage your cash flow more easily.

- Expense management: Keep track of all your paid bills in the same place through a dashboard.

- Tax Preparation: QuickBooks simplifies tax preparation by categorizing transactions and generating tax-ready reports. As they say, they keep track of tax laws, so you don’t have to.

- Financial Reports: Generate a variety of financial reports, including profit and loss statements, balance sheets, and cash flow statements.

- Integration: QuickBooks connects with various third-party applications, such as payment gateways and e-commerce platforms like PayPal, Square, and Shopify, among others, which streamlines your workflow and eliminates duplicate data entry.

Read also: The guide to how to bill a client.

The software claims to have tools and solutions for a wide range of businesses and individuals across various industries, such as restaurants, nonprofits, manufacturing, freelancers, small businesses, and mid-size businesses.

Overall, QuickBooks offers a comprehensive suite of features that streamline accounting processes. It automates many financial tasks, saving manual data entry and calculation time. With these features, it:

- reduces the chances of errors through accurate billing

- provides customizable templates

- easily integrates with other tools, which streamlines your workflow and eliminates duplicates.

QuickBooks pricing depends on the chosen plan and the kind of business you own.

- Independent contractors and freelancers, for example, may choose between the self-employed plan for $20 per month, the self-employed tax bundle plan for $30 per month, or the self-employed live tax bundle for $40 per month.

- Small businesses have different plan options, with a starting price of $30 per month until an advanced plan of $200 per month.

Easily integrate Timeular with QuickBooks

QuickBooks pros and cons

| Pros | Cons |

|---|---|

| Easy integration | Requires a learning curve |

| User friendly | More expensive than other apps |

| Customizable |

Reviews

App Store: 4.7/5

Google Play Store: 3.7/5

2. FreshBooks

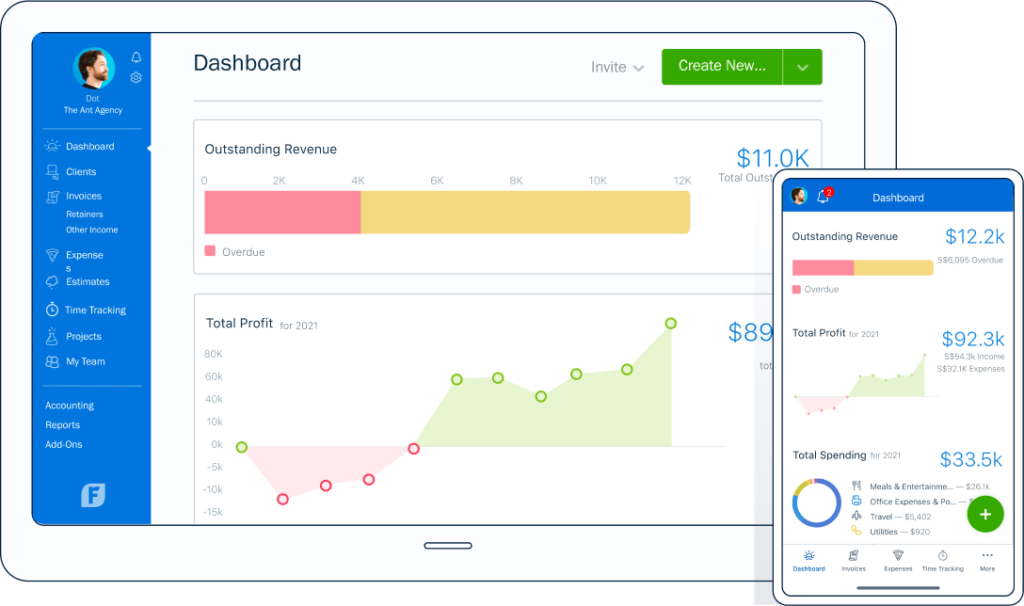

FreshBooks is an accounting and invoicing software designed for small businesses, freelancers, and self-employed professionals who need basic accounting features.

It aims to simplify financial management and help users stay organized by offering a user-friendly platform with invoicing, expense tracking, time tracking, and more features.

FreshBooks provides a clear picture of your business’s unpaid earnings and overall profit through its dashboard. The sidebar guides you through payments, expenses, and other essential tasks, and the simple design ensures straightforward comprehension.

FreshBooks is a versatile accounting and invoicing tool for freelancers, solopreneurs, and small business owners. Crafting invoices and receiving payments via credit cards, ACH transfers, Stripe, or PayPal is very simple with FreshBooks.

FreshBook’s top features include:

- Intuitive and easy-to-use interface: FreshBooks is known for its simple and intuitive interface, making it easy for non-accounting professionals.

- Time tracking: The software offers time tracking capabilities, particularly useful for service-based businesses and freelancers who bill clients based on hours worked.

- Reporting: FreshBooks generates financial reports such as profit and loss statements, expense reports, and tax summaries to provide insights into your business’s financial health.

- Integrations: While not as extensive as other platforms, FreshBooks offers integrations with popular tools like PayPal, Stripe, and G Suite.

Probably one of the best client billing software for freelancers, with pricing starting at $15 per user per month.

FreshBooks pros and cons

| Pros | Cons |

|---|---|

| Intuitive interface | Not suitable for larger businesses |

| Easy to use | Limited account features and customization options |

| Cheaper than competitors | |

| Ideal solution for freelancers and small businesses |

Reviews

App Store: 4.7/5

Google Play Store: 4.3/5

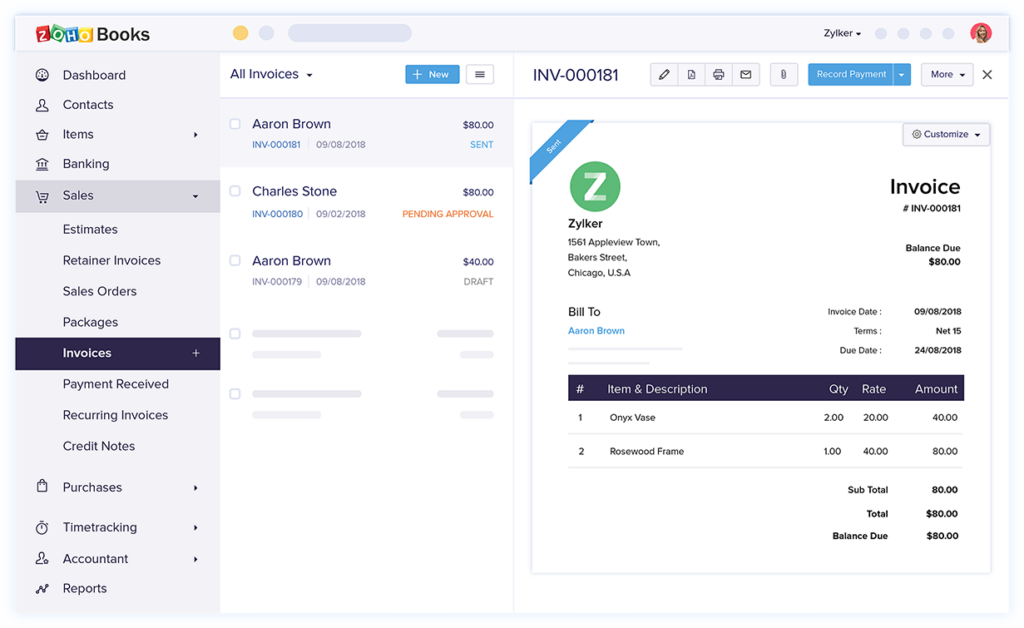

3. Zoho Invoice

Zoho Invoice is a free online invoice and client billing software designed to help freelancers and small businesses with invoicing and payment processes straightforwardly.

The software allows you to send up to 1,000 invoices per year, accept payments, keep a record of the invoices that were sent and received, record offline payments, and keep track of all the payments.

Zoho’s top features include:

- Invoicing: You can create customized invoices with your branding, itemize products or services, and include payment terms. It supports various invoice templates, customization options, and multiple currencies.

- Quotes: You can create estimates for potential clients, detailing project costs and scope. Once approved, estimates can be easily converted into invoices.

- Online payments: Zoho Invoice integrates with over ten payment gateways, which allows you to pick the one that suits you better and collect payments online.

- Time tracking: You can track billable hours for projects and tasks, enabling accurate invoicing for hourly services.

- Reporting: Zoho Invoice generates financial reports like profit and loss statements, tax summaries, and expense reports to assist in business analysis.

- Automation: You can set up recurring invoices and even send payment reminders to your clients or collect payments automatically.

Zoho offers a free plan, and then other monthly subscriptions starting from $59 per month.

Zoho Invoice pros and cons

| Pros | Cons |

|---|---|

| Free billing software | Not suitable for larger businesses |

| Customizable | Limited invoices per year |

| Easy to use | Limited features for the free tier |

Reviews

App Store: 4.8/5

Google Play Store: 4.5/5

Read also: What is project billing?

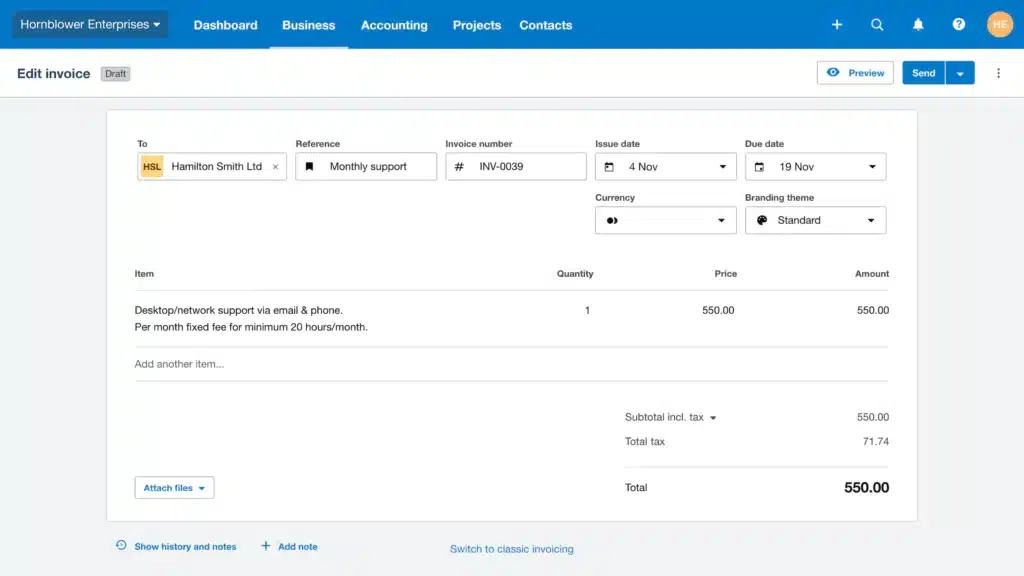

4. Xero

Xero is a top accounting and client billing software that suits businesses of various sizes, from small to medium-sized organizations needing comprehensive accounting capabilities, inventory management, and advanced reporting features. It offers a range of features to manage financial tasks, invoicing, expense tracking, and more.

Xero’s main features include:

- Online invoicing: You can send invoices, automate reminders, and track your payment status.

- Bank connections: With Xero, you can connect your bank account to the application and set up bank feeds.

- Payments: The software allows you to accept online payments by credit or debit cards straight from your invoice and to get paid in over 160 currencies with multi-currency accounting.

- Reporting: The software offers a variety of financial reports, such as profit and loss statements, balance sheets, and cash flow reports, providing insights into your business’s financial health.

- Integration: You can enhance your business and customize Xero by integrating apps into the account.

Xero offers a 30-day free trial period and plans that may vary from $25 per month to $54 per month.

TIP: Increase your productivity and business profitability with this Xero time tracking integration.

Xero’s pros and cons

| Pros | Cons |

|---|---|

| Free 30-day trial | Prices are a bit higher than others |

| 24/7 online support | Requires a learning curve |

| Extensive integration capabilities |

Reviews

App Store: 4.6/5

Google Play Store: 4.2/5

5. Square Invoices

Square Invoices is a free invoicing solution provided by Square that helps you send invoices, receive payments, and process payments. It also offers business owners many features to run and organize their businesses.

Square’s main features include:

- Invoicing: Square Invoices allows you to create and send customized invoices to clients directly from your Square Dashboard or mobile app, including details about the products or services provided.

- Online Payments: Clients can conveniently pay invoices online using credit and debit cards directly through the invoice.

- Client Management: The software provides a client directory to store client information, track transaction history, and maintain a clear record of interactions.

- Integration: Square Invoices seamlessly integrate with other Square products, such as the Square Point of Sale system and the Square Payments platform.

Square pros and cons

| Pros | Cons |

|---|---|

| Free service | Limited advanced features |

| Multiple payment methods | Integrations are limited to Square products |

| Unlimited invoices |

Reviews

App Store: 4.8/5

Google Play Store: 4.7/5

6. Wave

Wave is a free cloud-based invoicing software suitable for small businesses that allows you to track your payments, bills, and expenses in one place.

Wave’s main features include:

- Invoicing: Create and send customized invoices, estimates, and receipts and automated reminders to your clients.

- Accounting: Get unlimited income and expense tracking, make bank connections, and add unlimited partners or collaborators.

- Payments: Accept multiple payments such as credit and debit cards, bank deposits, and Apple Pay.

- Mobile receipts: Unlimited receipt scanning and accurate reports all in one place.

Wave pros and cons

| Pros | Cons |

|---|---|

| Free software | Limited customer support |

| User-friendly | A lot of optional paid features |

You might be interested in: Is revenue more important than profit?

Reviews:

App Store: 4.5/5

Google Play Store: 3.7/5

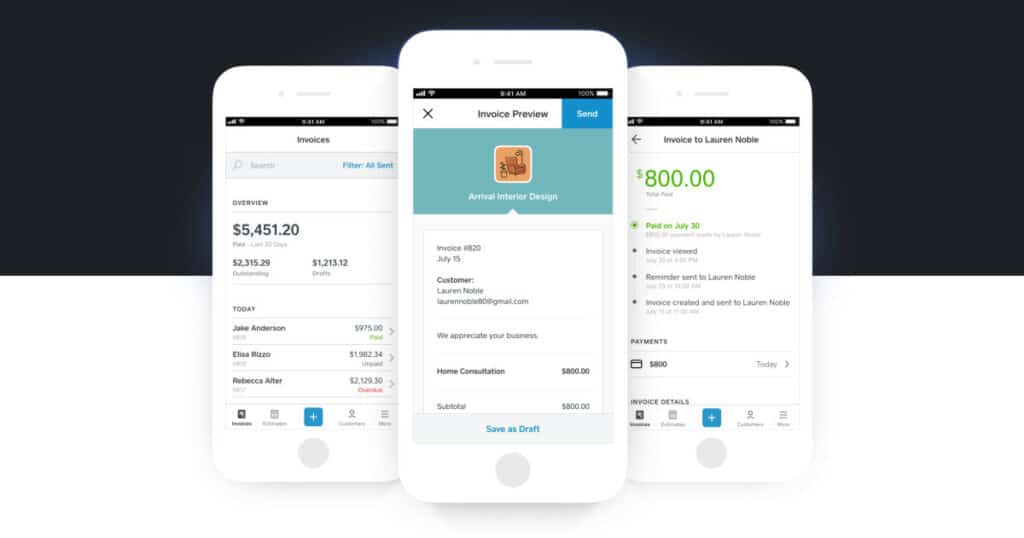

7. Invoice2go

Invoice2go is a very basic but efficient mobile invoicing and billing software.

It was designed to help small business owners, freelancers, and self-employed professionals create and manage invoices on the go.

Invoice2go main features include:

- Customized invoices: Invoice2go allows you to create professional invoices with customizable templates to add your logo, products, or services and include payment terms.

- Payment reminders: Invoice2go sends payment reminders to clients for overdue invoices, reducing the need for manual follow-up.

- Expense tracking: You can track and categorize expenses, helping you manage business costs and maintain accurate financial records.

Prices start at $5.9 per month on the starter plan and $39 per month on the premium plan.

Invoice2go pros and cons

| Pros | Cons |

|---|---|

| Mobile accessibility | Basic financial management |

| Online payments | Not suitable for bigger organizations |

| User-friendly |

Reviews

App Store: 4.8/5

Google Play Store: 4.2/5

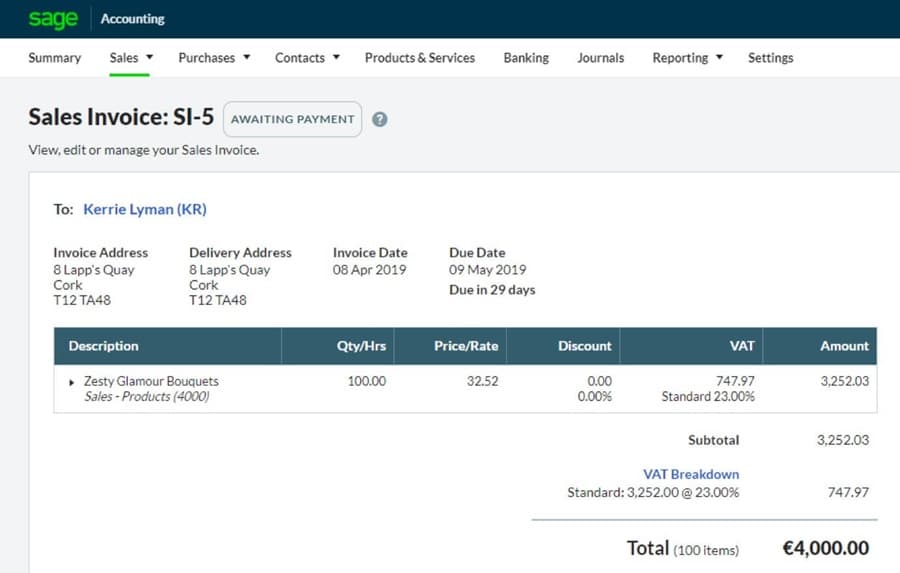

8. Sage Business Cloud Accounting

Sage Business Cloud is one of the greatest invoicing and client billing software for small businesses and startups. It seeks a comprehensive yet user-friendly accounting solution to help them manage their finances.

The software helps with daily tasks such as invoicing, payments, and even inventory, as well as recording and processing financial transactions.

Sage’s main features include:

- Invoicing: Create, edit, and send invoices online through the software.

- Reporting: You get clear and easy-to-read reports from a single dashboard.

- Mobile app: You can manage all your expenses from your mobile phone, access your financial information, and more.

- Bank connections: Connect your bank account and create an automated bank feed so that your data is transmitted from your bank to the software.

The software offers two packages: start, if your business is just starting, and standard, a more advanced version of the plan, which is more suitable depending on your type of business. Prices start at 10$ per month per user, with a 30-day free trial.

Sage pros and cons

| Pros | Cons |

|---|---|

| Scalability | Learning curve |

| User friendly | Pricing, depending on your location (US or EU) |

| Free trial period |

Reviews

App Store: 4.2/5

Google Play Store: 3.1/5

Read also: The greatest time tracking systems for small business

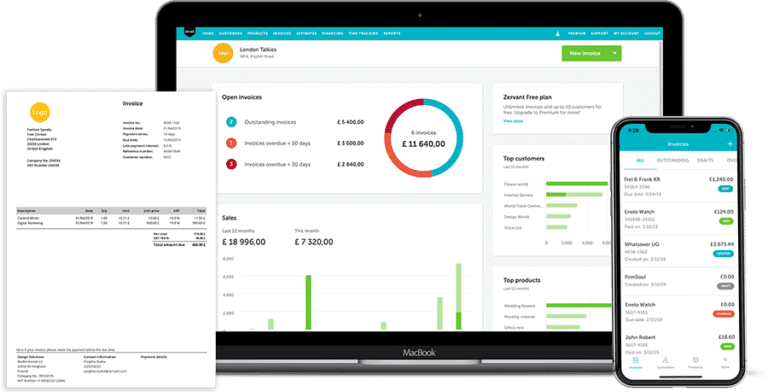

9. Zervant

Zervant is an invoicing and client billing app made explicitly for sole traders and small businesses. The software is straightforward and focuses on creating the best invoicing experience without requiring management experience.

Zervant’s main features include:

- E-invoicing: Create and send digital invoices

- Time tracking: An online time tracking tool tracks how long you spent working on projects.

- Payment reminders: You can send automated reminders to your clients.

- Online payments: Accept online payments via credit or debit card and in over 135 currencies.

- Mobile app: Zervant offers a mobile app allowing users to manage their invoices and finances on the go.

Zervant also offers a variety of plans, including a free option. Paid plans start at 8$ per month.

Zervant pros and cons

| Pros | Cons |

|---|---|

| Easy to use | Limited advanced features |

| Mobile friendly | |

| Free plan alternative |

Reviews

App Store: 5/5

Google Play Store: 4.7/5

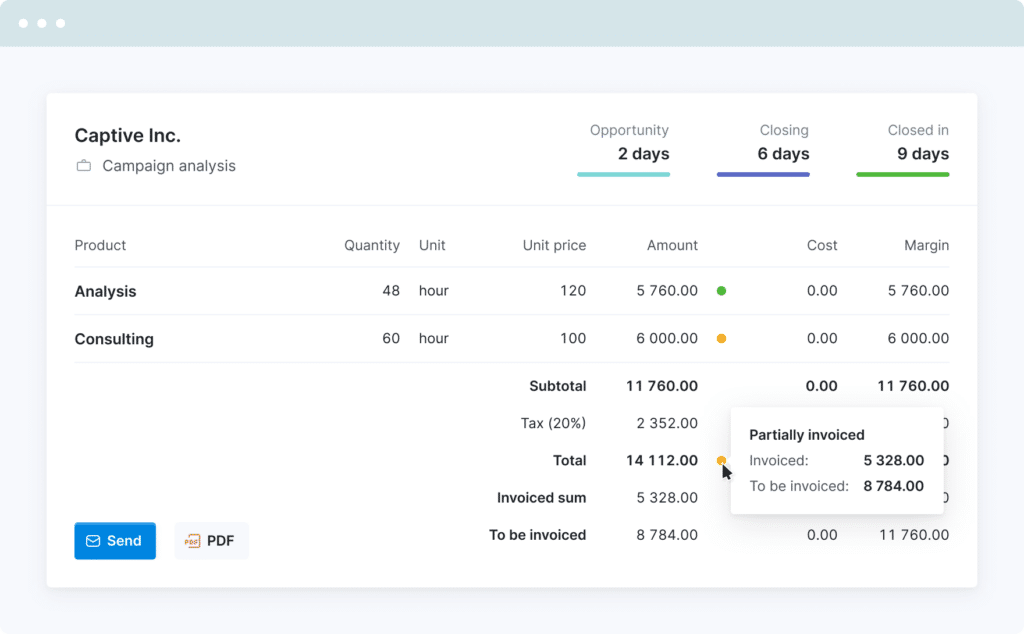

10. Scoro

Scoro is a more robust software, an all-in-one business management tool designed to streamline various aspects of project management, time tracking, financial management, and more for small to medium-sized businesses and creative professionals.

Scoro’s main features include:

- Project management: Scoro offers tools for planning, tracking, and managing projects, including task management, project timelines, resource allocation, and project collaboration.

- CRM: Scoro includes a CRM system to manage client interactions, track leads, and maintain a history of customer communications.

- Invoicing: Create professional invoices, track payments, and manage client billing efficiently.

- Reporting & Dashboards: You can create customizable dashboards to monitor KPIs and gain a real-time overview of your business’s operations.

Scoro offers a variety of plans with prices starting at $26 per month.

Scoro pros and cons

| Pros | Cons |

|---|---|

| A complete solution | Requires a learning curve |

| Integrations | Higher pricing compared to other software |

| Customizable | It may have more features than you need |

Reviews

App Store: 3.4/5

Capterra: 4.6/5

11. Chargebee

Chargebee is an invoicing and client billing app focused on companies that offer subscription services, such as SaaS companies, membership organizations, and subscription box services.

Chargebee provides all the necessary tools for managing subscriptions, invoicing, and recurring payments.

Chargebee’s main features include:

- Subscription management: Create, manage, and customize various subscription plans, including billing cycles, pricing tiers, and subscription options.

- Multiple integrations: Chargebee integrates with popular payment gateways, CRM systems, accounting software, and other tools.

- Invoicing: Chargebee generates and sends invoices to customers for their subscriptions, often including customizable invoice templates and options for online payment.

Chargebee offers a free starter plan for starting companies, a performance plan for scaling companies that costs 599$ per month, and an enterprise plan with the price upon request.

Chargebee pros and cons

| Pros | Cons |

|---|---|

| Automation | Requires a learning curve |

| Multiple integrations | Specific use case |

Reviews:

Capterra: 4.4/5

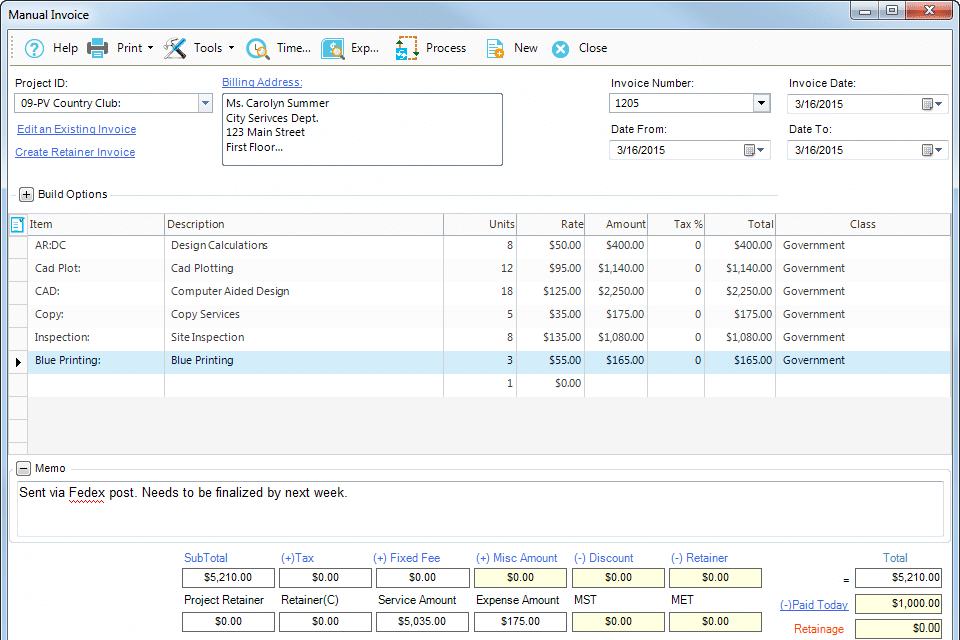

12. BillQuick Online

BillQuick Online is a software made for professionals on the move, making it a specialized solution for their project management and billing needs. It aims to streamline various aspects of project management, time tracking, expense management, and invoicing anytime, anywhere.

BillQuick’s main features include:

- Time Tracking: Track billable hours and time spent on projects, ensuring accurate project billing and employee payroll.

- Project management: The platform offers tools for project planning, task allocation, resource management, and project collaboration.

- Invoicing: Create customized invoices based on tracked time and expenses.

- Integration: BillQuick integrates with various accounting software, payment gateways, and other business tools.

BillQuick pros and cons

| Pros | Cons |

|---|---|

| Integrates easily | Requires a learning curve |

| Customizable templates | |

| Time tracking functionalities | Specific use case |

Reviews

Capterra: 4.5/5

13. Harvest

Harvest is an expense-tracking, time-tracking, and invoicing software designed for freelancers, small businesses, and teams that allows you to turn your working hours into invoices.

Read also: Find the perfect Harvest alternative.

Harvest’s main features include:

- Time tracking: Track the time spent on tasks and projects for accurate billing.

- Invoicing & payments: Create and send invoices based on tracked time and expenses. You can customize invoice templates and include payment terms.

- Reports & Analysis: Harvest generates reports that provide insights into project progress, time allocation, expenses, and financial data.

Harvest offers a free plan alternative; paid plans start at 10.80 dollars per month.

Harvest pros and cons

| Pros | Cons |

|---|---|

| User-friendly interface | Limited advanced features |

| Online payment options |

Reviews

App Store: 3.7/5

Capterra: 4.6/5

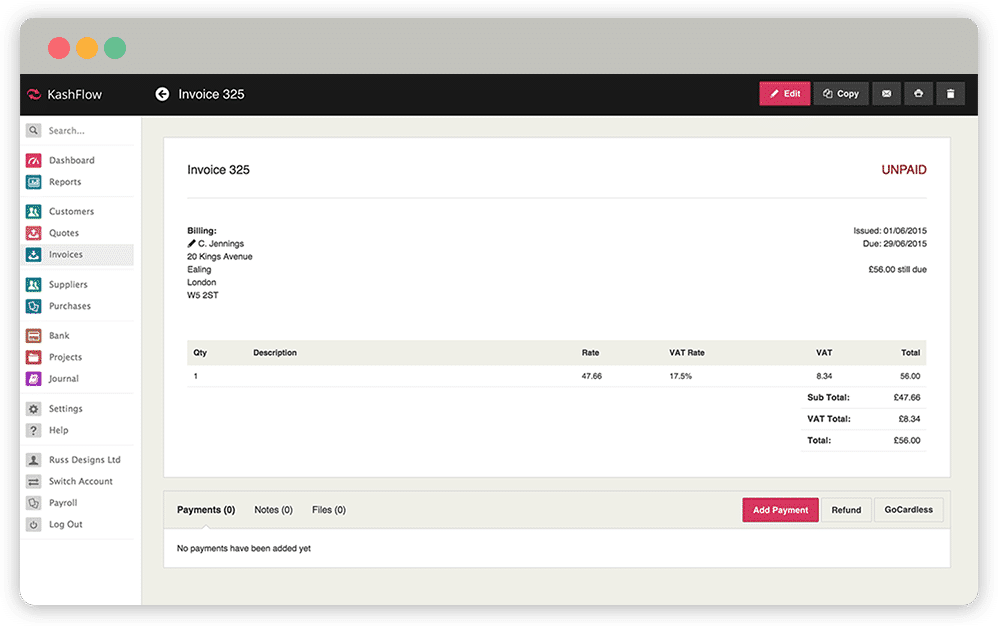

14. KashFlow

KashFlow is an online accounting software designed especially for small businesses, freelancers, and sole traders to manage their financial tasks, invoicing, expenses, and more.

It provides a range of features to simplify financial management and streamline administrative tasks in a very simple and easy-to-use interface.

KashFlow’s main features include:

- Invoicing: Create professional invoices, customize templates, and include payment terms. You can also set up recurring invoices for subscription-based services.

- Expense tracking: Track and categorize business expenses, attach receipts, and maintain accurate financial records.

- Online payments: KashFlow supports online payment options, allowing clients to pay invoices directly through integrated payment gateways.

- Integrations: It integrates with various third-party apps, such as payment gateways and CRM systems.

KashFlows offers free trial periods and different plan options starting at $10.50 per month.

KashFlow pros and cons

| Pros | Cons |

|---|---|

| Free trial period | Low scalability |

| Multiple integrations | Requires a learning curve |

Reviews

Capterra: 4.5/5

Read also: Time tracking apps for freelancers

15. Bill.com

Bill.com is a financial management platform designed to streamline and automate various processes for small businesses and midsize companies.

It focuses on simplifying the process of paying and receiving invoices, managing approvals, and facilitating collaboration between finance teams and vendors.

Bill.com’s main features include:

- Multiple integrations: The platform integrates with accounting software like QuickBooks and Xero to sync financial data and streamline bookkeeping.

- Invoicing: Create professional and customizable invoices, track the payment status, and manage receivables efficiently.

- Payment processing: Bill.com supports various payment methods, including ACH transfers, virtual credit cards, and check printing, facilitating secure and streamlined payment transactions.

Bill.com pros and cons

| Pros | Cons |

|---|---|

| Multiple integrations | More expensive than others |

| Automation | Requires a learning curve |

Reviews

App Store: 4.9/5

Google Play Store: 4.5/5

The benefits of using a client billing app

The main benefits of using a client billing app or software are accuracy and time-saving.

The accuracy of calculations on billing software is much bigger than doing the same thing manually, reducing potential errors.

It also streamlines the whole invoicing process, saves valuable time for you or your team, and helps you automate daunting tasks. The convenience of automation extends to recurring invoices, ideal for subscription-based models.

Billing apps also facilitate record-keeping, expense tracking, and insightful reporting, optimizing financial management. Notifications for overdue payments and mobile accessibility increase operational efficiency, while security features safeguard sensitive financial data.

In summary, using client top billing software elevates invoicing efficiency, financial accuracy, and overall business professionalism.

How to choose the best client billing software

When choosing your billing software, you must consider several factors and research your options so that you can make a decision based on your specific business needs.

- Invoicing: Look for customizable invoices with branding and recurring options.

- Payment Options: Choose software that supports various payment methods.

- Time and Expense Tracking: Prioritize tools that help track billable hours and expenses.

- Automated Reminders: Opt for software with automated payment reminders.

- Reporting: Ensure the software offers detailed financial reports.

- Multi-Currency and Tax Support: Check for international invoicing and tax handling.

- Integration: Look for compatibility with your accounting software.

- User-Friendly: Choose intuitive software for you and your team.

- Security and Compliance: Ensure data security and regulatory compliance.

- Scalability: Pick software that can grow with your business (only if it’s your plan).

- Customer Support: Choose a provider with reliable customer assistance.

- Cost: Evaluate pricing plans and trial options.

By considering these factors, you can find a software solution that suits your business needs.

Conclusions

The process of creating invoices, sending them, and chasing payments can be a drain on time and money. And today, we’ve seen the most popular solutions to make billing smoother and more cost-effective.

Before diving into software reviews, you’ve also learned a golden tip: time tracking is the secret sauce for faster invoicing.

Accurate time tracking ensures transparent, precise, and productive billing. It builds client trust, captures all billable tasks, and reveals time-consuming activities for optimization. We recommend using Timeular to track billable time effortlessly and build reports in less than a minute.

The top billing software options we saw together are: QuickBooks, FreshBooks, Zoho Invoice, Xero, Square Invoices, Wave, Invoice2go, Sage Business Cloud Accounting, Zervant, Scoro, Chargebee, BillQuick Online, Harvest, KashFlow, and Bill.com. These software solutions simplify invoicing, automate reminders, track expenses, and generate reports. Some cater to specific business types, like subscription services or project management.

By choosing the right client billing software, you’ll enjoy accurate, automated, and professional invoicing, leaving you more time and resources to focus on growing your business.

You might be interested in: